About the Columbia University Student Health Insurance Plan

Last updated: 4/11/2024

How does the Columbia Plan work with Columbia Health?

Having insurance is key to helping ensure predictable health care costs and to support students in the achievement of their personal and academic goals. In an effort to reinforce this aim, Columbia requires most students to have comprehensive health insurance as part of enrollment in the University.

The Columbia Plan works with Columbia Health to provide consistent, efficient care. The plan will always pay benefits in accordance with applicable New York State insurance laws.

Medical Services provides primary care for students enrolled in the Columbia Plan. Clinicians in Medical Services and Counseling and Psychological Services work closely with Aetna Student Health claims administrators to arrange access to benefits available through the Columbia University Student Health Insurance Plan.

Student Insurance Key Information

The Columbia Plan may not cover all of your health care expenses. Read the Student Health Insurance Plan Brochure carefully before making your insurance decision.

About Enrollment

New incoming summer students may request enrollment in the Student Insurance Plan plan beginning May 1 through June 30, for coverage effective May 15 through August 14, 2024. After this time period you will not be able to enroll without a Qualifying Life Event (QLE).

Each academic year, all registered full-time students must make an insurance selection. They must either:

- Confirm enrollment in the Columbia Plan (Columbia University Student Health Insurance Plan), or

- Request a waiver from mandatory enrollment in the Columbia Plan (eligible students only)

Full-time students will be enrolled in the Columbia Plan if they do not make an enrollment selection or if no waiver request has been submitted by the open enrollment deadline.

Funded graduate students should contact their departmental administrator, financial aid office, or fellowship office for information about whether their school provides funding to cover any portion of The Columbia University Student Health Insurance Plan premium for the student and eligible dependents.

Students at Union Theological Seminary, Jewish Theological Seminary, and Columbia University Medical Center should contact their school for health insurance information.

Incoming part-time domestic students are not automatically enrolled in the Columbia plan. However, they may request enrollment in the Columbia Plan by the deadline and are encouraged to do so. Enrolling also requires payment of the Full-time Columbia Health and Related Services Fee, which provides access to the services offered by Columbia Health.

Navigating the US Health Care System can be complex. To help ensure that international students have access to the highest quality of care on- and off-campus, Columbia University requires all international students to enroll in the Columbia Plan.

International students are defined as any enrolled student that is not a US Citizen or Permanent Resident. All international students, regardless of the number of enrolled credits, will be enrolled in the Columbia Plan.

Some international students may be eligible for a waiver when covered by a plan that meets the University requirements. Please review the Waiver section of the website for more details. All eligible waiver requests are considered though no approval is guaranteed. All determinations regarding exemptions are made by the Student Health Insurance Office on the Morningside Campus and shall be considered final.

Student-veterans may be eligible for health care benefits through the Department of Veterans Affairs for illnesses and injuries related to their service. Columbia Health recommends that student-veterans confirm their status with Veterans Affairs and, if necessary, complete the paperwork needed to receive benefits in the New York City area.

Full time student-veterans will be default enrolled into the Columbia Plan and billed the insurance premium, unless a waiver request is submitted via the Patient Portal and approved by the appropriate deadline.

For additional information about health care coverage for Columbia student-veterans, visit the Student Financial Services Veterans & Service Members website.

If you are a dual-degree student (for example, TC/MBA or SPH/SIPA, etc.), and are transferring campuses mid-academic plan year (fall/spring), the following will apply:

The campus where you begin your academic enrollment determines your Health and Related Service Fee (HRSF) and Aetna Student Health Insurance Plan enrollment for the entire plan year (August 15 – August 14). For example, if you begin your enrollment at one of the affiliate schools (CUIMC, Teachers College, Union Theological Seminary, or Jewish Theological Seminary) in the fall, you will remain enrolled on that student health insurance plan through August 15 as long as you remain a registered student.

- Date

- July 15 to September 30

- Notice

- Open enrollment period

- Date

- August 14

- Notice

- Coverage terminates for spring and summer enrollees.

- Date

- August 15

- Notice

- Coverage begins for the new academic year.

- Date

- September 30

- Notice

- The Columbia Plan open enrollment deadline. Full-time domestic students and all international students who have taken no action by this date will be enrolled in The Columbia Plan for the entire insurance plan year. Domestic part-time students who have taken no action by this date will not be enrolled.

- Date

- December 15 to February 15

- Notice

- Open enrollment for new incoming spring students begins.

- Date

- December 31

- Notice

- The Columbia Plan fall term coverage ends. Students completing their program or not registering for spring classes will term effective December 31 and not be charged spring insurance premiums.

- Date

- January 1

- Notice

- The Columbia Plan spring term begins.

- Date

- February 15

- Notice

- The Columbia Plan open enrollment deadline for new spring students. Full-time domestic students and all international students who have taken no action by this date will be enrolled in The Columbia Plan through August 14. Domestic part-time students who have taken no action by this date will not be enrolled.

- Date

- May 1 to June 30

- Notice

- Open enrollment for new incoming summer term students begins.

- Date

- May 15

- Notice

- Coverage for new summer students begins; coverage ends August 14.

- Date

- June 30

- Notice

- The Columbia Plan open enrollment deadline for new summer students only. Full-time summer trimester domestic students and all international students who have taken no action by this date will be enrolled in The Columbia Plan for the coverage period May 15 to August 14.

If you have existing coverage and missed the Open Enrollment deadline or obtained new coverage after the plan start date, you must request a late Insurance Waiver Request via the Qualifying Life Event (QLE) Petition form in your Patient Portal. The QLE form is in your Patient Portal under the Downloadable forms option in the left menu. If you had existing coverage, the form should explain why you could not submit it during the Open Enrollment Period. Provide the Certificate of Coverage from your existing/new insurance with the effective date and copies of the insurance card (front and back). Please allow up to 10 business days to process. If approved, you will receive a pro-rated refund of your insurance premium.

To add or remove a Spouse, Domestic Partner, or Child(ren) to the plan after Open Enrollment, they will need to be experiencing a Qualifying Life Event (QLE). Examples: just married or divorced, received a certified domestic partnership, newborn/adoption, lost other coverage, death of a covered dependent, or recently relocated from a different country. You will need to provide the marriage, domestic partnership, or divorce certificate, loss of coverage letter, birth or death certificate, or proof of when they entered the country. The QLE form is in your Patient Portal under the Downloadable forms option in the left menu. This form must be submitted within 60-days of the QLE. If approved, you will be charged a pro-rated insurance premium.

About the Plan

For the 2023-2024 academic year (August 15, 2023 - August 14, 2024), Columbia University is offering The Columbia Aetna Plan to meet students’ health-related needs beyond the on-campus services offered by Columbia Health. The Columbia Plan includes benefits for medical and mental health conditions including but not limited to chiropractic care, prescriptions, travel abroad benefits and more. The Columbia Plan is a worldwide plan providing access to coverage throughout the U.S. and internationally.

Highlights:

- No in-network deductible

- $30 office copay

- $0 copay for the first 10 mental health visits; $20 mental health copay for subsequent visits

- $150 emergency room copay

- $60 urgent care center copay

- $15/$50/$75 prescription copays

- $30 co-pay on in-network services (e.g. laboratory, radiology)

- $3,000 in-network annual out-of-pocket maximum

- Dental discounts at ColumbiaDoctors Dentistry

During the Fall and Spring terms only, Columbia Health also offers a voluntary vision insurance plan in addition to the voluntary dental insurance plan.

Put together, these medical, dental, and vision options provide a comprehensive coverage package for our students at prices substantially lower than plans offered via the New York State Healthcare Marketplace.

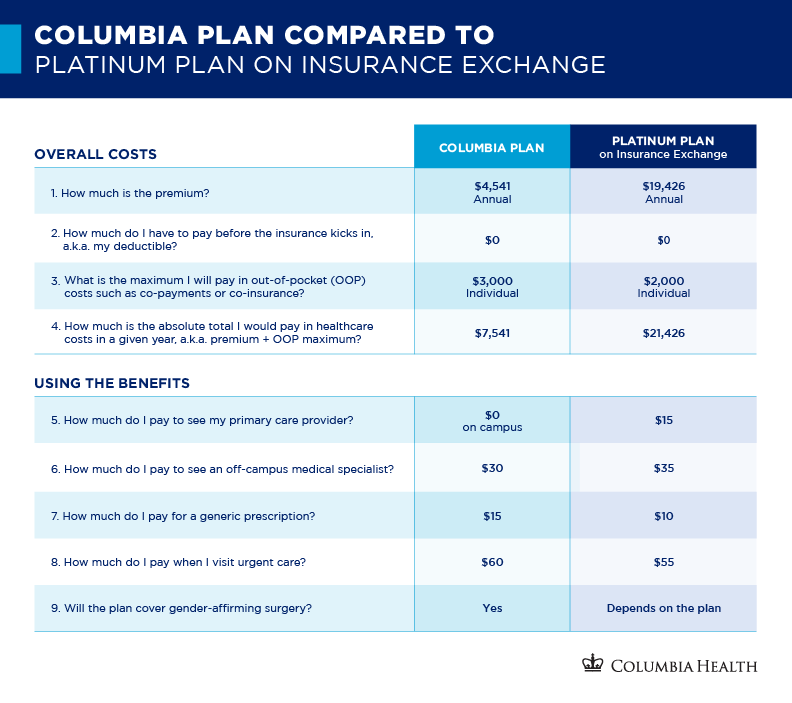

How do the Columbia Plan's cost and benefits compare to a plan with similar coverage on the insurance exchange?

Mental Health Visits -

- $0 copay for the first 10 outpatient in-network mental health visits. Subsequent visits will be charged the $20 copay. Please remember referrals are still required from Counseling and Psychological Services.

Travel and Lodging Expenses -

- The Aetna Student Health Plan will reimburse certain travel and lodging expenses for You to travel at least 100 miles from Your location to another State to access Covered Services when access to Covered Services is not available to You due to a law or regulation in the State where You are located, unless such reimbursement is prohibited by law. Aetna will also reimburse travel and lodging expenses for a companion to accompany You, if the companion is a Member covered under the Columbia Aetna Student Health Plan and the companion’s presence is necessary for You to receive Covered Services. Aetna will reimburse You up to $3000 per Plan Year for You and Your companion’s travel and lodging expenses not to exceed amounts permitted by Internal Revenue Service guidelines Lodging expenses are limited to $50 per night for You, or $100 per night if You are traveling with a companion.

For information regarding Dental and Vision insurance please visit Voluntary Plans.

Dental Discount Benefits for Students Enrolled in the Columbia Plan

Students enrolled in the Columbia Plan have access to covered preventive dental services and specially discounted rates for other dental needs through Columbia Doctors Dentistry*.

ColumbiaDoctors Dentistry* offers students appointments for a $20 copay per visit, and include the following:

- One routine examination per plan year

- X-rays as needed with the routine examination

- One dental cleaning (prophylaxis) per plan year

- Evaluation of emergency dental conditions

- A 25% discount off self-pay fees on additional services

*These dental discounts are operated by Columbia Doctors Dentistry and are not underwritten by Aetna or administered by Aetna Student Health. Columbia Doctors Dentistry is not affiliated with Columbia Medical Services on the Morningside Campus.

Please note there is no coverage for dental services under the Columbia Aetna plan except for removal of impacted wisdom teeth and care or treatment due to accidental injury to sound natural teeth within 12 months of the accident and dental care or treatment necessary due to congenital disease or anomaly (please refer to page 49 of the Aetna Plan Summary PDF (2022-23).

Locations

- 1244 Amsterdam Ave., New York, NY 10027; 212-342-2300

- 430 W. 116th St., New York, NY 10027; 212-662-4887

- 100 Haven Ave., Ground Floor, New York, NY 10032; 212-342-0107

- 51 W. 51st St., 3rd Floor, New York, NY 10019; 212-326-8520

Aetna Vision℠ Discount Program for Students Enrolled in the Columbia Plan

The Aetna Vision℠ Discount Program is available to all students enrolled in the Columbia Plan, which provides access to discounted prices for many eye care products, including sunglasses, contact lenses, non-prescription sunglasses, contact lens solutions, and other eye care accessories. Plus, students can receive discounts on LASIK surgery, the laser vision correction procedure. A listing of participating providers is available through the Aetna DocFind© feature.

Providers closest to the Morningside campus are:

- Columbia Opticians, 1246 Amsterdam Ave. (at 121st St.); 212-316-2020

- LensCrafters, 2770 Broadway (between 106th and 107th streets); 212-678-0530

Aetna Student Health maintains a comprehensive network of providers within the United States. When students are 50 miles or more away from campus and need routine, urgent or emergency care, they may select an in-network provider using the Provider Search feature on the Aetna Student Health website for Open Choice Student Health Medical Plans. Medically necessary care, received by an in-network provider, is covered by Aetna Student Health according to the plan design.

The Columbia Plan year is effective from August 15 to August 14 contingent on student registration and tuition charges.

- Students beginning their academic program any time during the fall and continue as a registered student in the spring term, coverage is effective at 12:00 a.m. August 15 and ends at 11:59 p.m. August 14. This includes spring graduates.

- Students completing an academic program in December in anticipation of a February graduation, or those who do not register for Spring courses are covered through 11:59 p.m. December 31 and are billed the fall premium only.

- Students graduating in October are categorically ineligible for enrollment in the Columbia Plan. Eligibility for coverage ended August 14.

- Spring: Coverage for new spring admitted students is effective 12:00 a.m. January 1 through 11:59 p.m. August 14.

- Summer: Coverage for new summer admitted students is effective 12:00 a.m. May 15 through 11:59 p.m. August 14.

Eligibility for the plan is contingent on course registration and tuition charges for all students. There is no option to begin the plan earlier than the dates specified above.

For students entering the fall term who have not actively enrolled in the Columbia University Student Health Insurance Plan, registered for classes and been charged tuition, may need to submit expenses for covered prescriptions filled before their coverage has been activated to Aetna Pharmacy Management for reimbursement. For more information, see Aetna’s Commercial Prescription Drug Claim Form.

Once an insurance coverage decision has been determined for the fall term either by automatic enrollment, online selection, or waiver request, that decision will automatically be continued in the following spring term as long as the student remains registered at the University.

The total health insurance premium includes fee-for-service items provided by Columbia Health, a preventative dental benefit, as well as administrative expenses associated with servicing the insurance plan (including certain personnel expenses incurred by the Columbia Health Insurance office). In addition, based on aggregate claims experience, Aetna may issue a refund to Columbia to be applied toward future premiums. For more information, contact Aetna Student Health Customer Service at 800-859-8471.

Funded graduate students should contact their departmental administrator, financial aid office, or fellowship office for information about whether their school provides funding to cover any portion of The Columbia Plan premium for the student and eligible dependents.

- The Columbia Plan

- Fall Term

Aug. 15 – Dec. 31, 2023 - Spring/Summer Term

Jan. 1 - Aug. 14, 2024 - Academic Year

Aug. 15, 2023 - Aug. 14, 2024

- The Columbia Plan

- Morningside

- $1,725

- $2,816

- $4,541

- The Columbia Plan

- Teachers College

- $2,145

- $3,502

- $5,647

- Summer Term (New summer students only)

May 15 - Aug. 14, 2024 - Morningside

- $1,145

- Summer Term (New summer students only)

May 15 - Aug. 14, 2024 - Teachers College

- $1,423

Note: The Columbia University Student Health Insurance Plan may not cover all of your health care expenses. The plan excludes coverage for certain services and contains limitations on the amounts it will pay. Please read the Columbia University Student Health Insurance Plan brochure carefully before deciding which plan is right for you. While this document will tell you about some of the important features of The Plan, other features may be important to you and some may further limit what The Plan will pay.

If you are enrolled in the Columbia University Student Health Insurance Plan, your primary care provider is at Columbia Health Medical Services and your initial mental health provider is at Counseling and Psychological Services. A referral by a Medical Service or Counseling and Psychological Services clinician is mandatory when seeking non-emergency off-campus services. If a referral is not obtained prior to seeking care, services will be reimbursed at the out-of-network benefit level at a higher out-of-pocket cost.

Watch this video for more information: How to: Referrals and the Columbia Plan.

Note: Referrals cannot be issued after a student has received off-campus services.

Note for students on the Columbia University Student Health Insurance Plan: ColumbiaDoctors practice groups are not part of Columbia Health and are considered an off-campus provider. You need a referral from your on-campus Columbia Health provider to see these specialists.

The Columbia University Student Health Insurance Plan may not cover all of your health care expenses. The plan excludes coverage for certain services and contains limitations on the amounts it will pay.

Read the Columbia University Student Health Insurance Plan brochure carefully to better understand the plan.

While this document will tell you about some of the important features of the plan, other features may be important to you and some may further limit what the plan will pay.

It is the student's responsibility to make sure an off-campus provider is a preferred provider in the Aetna network to be eligible for the highest level of benefits. If students elect to receive care from an out-of-network provider, charges in excess of the allowed amount and applicable deductible or co-insurance will not be covered, and students will be financially responsible for those charges.

Watch this video for more information: How to Submit Claims Through the Aetna Member Portal.

Students can visit the Aetna Student Health website for a full listing of providers nationwide. Click on “Find a Doctor,” enter the local zip code, and indicate membership in a "Student Health Plan.” Students can also access their insurance information through the Aetna Mobile app.

After students obtain a referral from their Columbia Health primary care or mental health provider, they should select an Aetna in-network provider to maximize savings and reduce out-of-pocket expenses. Students can achieve significant savings through the agreement with Aetna regarding rates of payment for services.

It is the student's responsibility to make sure an off-campus provider is a preferred provider in the Aetna network to be eligible for the highest level of benefits. If students elect to receive care from an out-of-network provider, charges in excess of the allowed amount and applicable deductible or co-insurance will not be covered, and students will be financially responsible for those charges.

Using the Provider Directory

Participating providers are independent contractors in private practice and are neither employees nor agents of Aetna Student Health or Columbia University. The availability of any particular provider cannot be guaranteed for referred or in-network benefits. Provider network composition is subject to change without notice.

Certain primary care physicians may be affiliated with an independent practice association, a physician medical group, an integrated delivery system, or one of other provider groups.

Not every provider listed in the directory will accept new patients. Although Aetna has identified providers who were accepting patients at the time the directory was created, the status of a provider's practice may have changed. For the most current information, contact the selected physician or Aetna Student Health at 800-859-8471.

In the event of a problem with coverage, contact Aetna Student Health to learn how to utilize the complaint and appeals procedure when appropriate. All care and related decisions are the sole responsibility of participating providers. Aetna does not provide health care services and, therefore, cannot guarantee any results or outcomes.

Students can expedite receipt of their insurance ID by actively confirming enrollment in The Columbia Plan prior to the open enrollment deadline. After an online selection has been entered, a card is normally available to print by accessing the Aetna Student Health website 14 business days after registering for classes and being charged tuition & fees. Physical ID cards are only mailed upon request. To obtain an ID card by mail please call Aetna Customer Service at 800-859-8471. Students can also access their insurance information through the Aetna Mobile app.

To print an insurance ID card, please use the student's UNI and Date of Birth.

Prior to receiving access to print an insurance ID card, healthcare providers may require that students pay for the services and then seek reimbursement from Aetna Student Health (medical claims) or Aetna Pharmacy Management (pharmacy claims).

Watch this video for more information: How to Print Aetna Student Health Insurance Card.