Request a Waiver

Last reviewed: 2/16/2024

All full-time domestic students and all international students, regardless of registered credits, are automatically enrolled in the Columbia Student Health Insurance Plan (the Columbia Plan). In order to request a waiver from mandatory enrollment in the Columbia Plan, students must have alternate coverage that meets the University requirements. Students must provide sufficient information regarding their alternate health insurance plan to allow independent verification that the alternate plan meets the University requirements.

See step-by-step instructions for how to submit a waiver request.

➜ This checklist will help you determine if your health insurance plan meets the waiver criteria.

The Student Health Insurance Office on the Morningside campus considers all requests, but approval is not guaranteed. Previous waiver approvals do not guarantee future approvals - be sure to review the annual requirements before submitting a waiver request. Charges on the student account are only removed after a waiver request is approved.

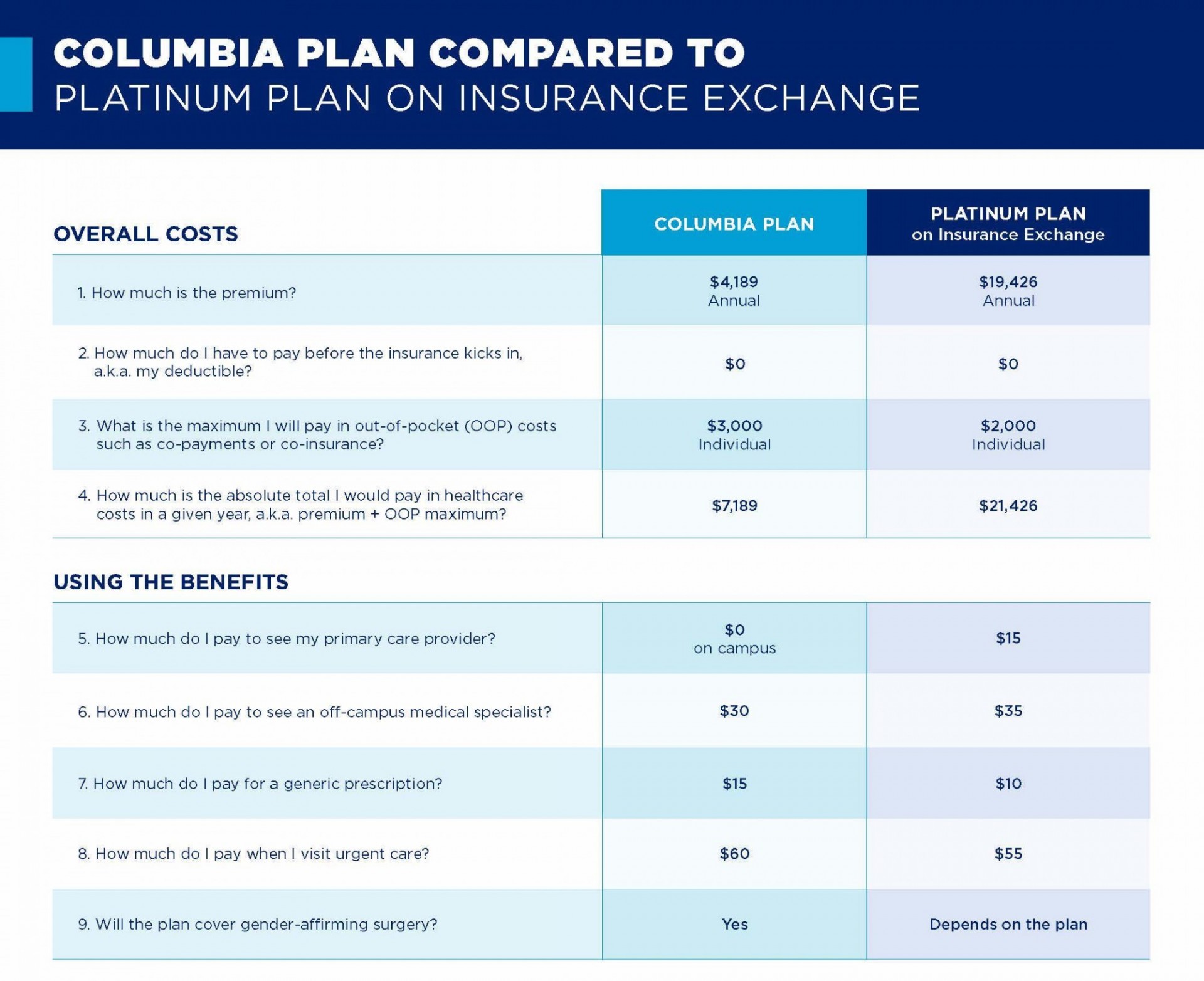

NOTE: The cost of the Columbia Plan is not a criterion or grounds for waiver consideration. See how the cost of the Columbia Plan compares to a similar level plan in the insurance exchange.

- Spring (New students only)

- Submit waiver requests starting:

- December 15, 2023

- Deadline for submission

- February 15, 2024

- Summer (New students only)

- Submit waiver requests starting:

- May 1, 2024

- Deadline for submission

- June 30, 2024

- Fall (New and continuing students)

- Submit waiver requests starting:

- July 15, 2024

- Deadline for submission

- September 30, 2024

Students are encouraged to submit waiver requests at least TWO WEEKS prior to the deadline to ensure adequate time from processing and to avoid unintended fees.

All requests for a waiver must be submitted through the Patient Portal. See step-by-step instructions.

Students whose waiver request was denied will be notified of the reason for the denial and may contact the Student Health Insurance Office to discuss the details. If students have any new information that was not previously provided when requesting a waiver, they may submit a request for reconsideration. Disagreement with denial of the waiver is not, by itself, grounds for reconsideration.

Insurance enrollment waivers are valid for the duration of the academic year and must be renewed if the student is continuing in the next academic year.

Domestic students

Please review your alternate coverage to determine whether it meets all of the following criteria:

- The plan must meet the requirements of the Affordable Care Act, including coverage for routine, urgent, and emergent care for all of the act’s Essential Health Benefits in New York State.

- The plan must be based in and licensed to do business in the United States.

- The plan must be effective and remain in force for the duration as noted below.

- No yearly or lifetime coverage maximums for essential health benefits.

➜ This checklist will help you determine if your health insurance plan meets the waiver criteria.

New Students

- Fall admits: August 15, 2023 to August 14, 2024

- Spring admits: January 1, 2024 to August 14, 2024

- Summer admits: May 15, 2024 to August 14, 2024

Continuing Students

- August 15, 2023 to August 14, 2024

Graduating Students

- August 15, 2023 to the last day of the month in the last academic term in which the student is registered

International Students

J-Visa Holders

U.S. government regulations mandate that all J-1 visa holders and their J-2 dependents have health and accident insurance during the entire length of their stay. As a result, J-visa holders are not eligible for insurance waivers.

All Other Visa Holders

Please review your alternate coverage to determine whether it meets all of the following criteria. Note that items 1-5 must be provided under a single health insurance plan.

- The plan must meet the requirements of the Affordable Care Act, including coverage for routine, urgent, and emergent care for all of the act’s Essential Health Benefits in New York State.

- The plan must provide routine coverage throughout the United States.

- The plan must be based in and licensed to do business in the United States.

- The plan must be effective and remain in force for the duration as noted below.

- No yearly or lifetime coverage maximums for essential health benefits.

- The plan must include medical evacuation (minimum of $50,000) and repatriation coverage (minimum of $25,000). This requirement may be met via a secondary coverage plan for evacuation and repatriation only.

➜ This checklist will help you determine if your health insurance plan meets the waiver criteria.

New Students

- Fall admits: August 15, 2023 to August 14, 2024

- Spring admits: January 1, 2024 to August 14, 2024

- Summer admits: May 15, 2024 to August 14, 2024

Continuing Students

- August 15, 2023 to August 14, 2024

Graduating Students

- August 15, 2023 to the last day of the month in the last academic term in which the student is registered

All students with approved waivers assume full personal responsibility for medical costs not covered by their health insurance plan.

Any domestic student with active New York State Medicaid coverage may request a waiver from the University insurance requirement. Requests from students with Medicaid coverage from outside New York State are typically denied if the student is living in New York, as these plans typically do not provide coverage outside of their state of residence. All waiver requests are evaluated on an individual basis.

When making waiver decisions, all Medicaid-covered students should consider the gaps in coverage they may experience while attending the University; for instance, travel abroad or anywhere outside their Medicaid state may not be included.

New York State Medicaid-covered students may not be covered while outside of New York. In addition, referral options for students enrolled in Medicaid plans needing specialists’ care off-campus may be limited.

Students with Medicaid who are interested in The Columbia Plan may wish to address concerns about cost with their school's financial aid office.

Every student’s policy coverage must meet the waiver requirements outlined by the University. Plans that do not meet these criteria are not considered adequate coverage and will not be accepted.

Requirements are established to minimize a student’s risk of incurring exorbitant medical costs and to ensure access to care. Students accept full personal financial responsibility for hospital, laboratory, physician, diagnostic testing, and other medical costs not covered by their insurance.

Charges on Your Student Account Statement

A charge for the Fall term of the Columbia University Student Health Insurance Plan may appear on the first student account statement, even if the student has requested a waiver. These charges will be removed after a waiver request is approved (please allow up to 10 business days after notification of an approval for charges to be adjusted).

Health insurance benefits and access to in-network providers vary from plan to plan. For students considering The Columbia Plan or enrolling in an alternate insurance plan, here are a few points to consider before making a decision:

- Does the alternate insurance plan meet University criteria for comparable insurance coverage?

- Will you age out of your parent or legal guardian’s insurance plan while you are at Columbia or during the current academic year?

- Does the plan offer a robust network of in-network providers in New York City?

- Does the plan offer nationwide routine care coverage and international coverage?

- What costs are involved in extending coverage provided through a previous employer, such as COBRA? Compare these with the premium for the Columbia University Student Health Insurance Plan.

A student unsure about how an alternate plan compares to The Columbia Plan should contact their insurance provider for details about available benefits, including access to in-network providers in New York City, cost of in- and out-of-network providers, cost of lab examinations, prescription medication benefits, and any other frequently used benefits. The compare your coverage tool can assist with decision-making.

Columbia University is not responsible for any costs incurred by a student associated with enrolling in an insurance plan that does not qualify for a waiver. Students are strongly encouraged to consult with the Student Health Insurance before purchasing other plans if they are considering requesting a waiver.

The Columbia Plan provides coverage for a broad range of healthcare needs, both while students are in the United States and abroad:

- Benefits are designed to complement services available on-campus (in-person and telehealth).

- An on-campus clinician serves as a student’s primary care provider (with no co-pay).

- Access to services is streamlined and paperwork is limited.

- Students pay a co-pay for visits with consulting providers off-campus* (when referred by an on-campus clinician) and for prescription medications*.

- The plan offers access to the nationwide Aetna network of specialists, representing clinicians in most areas of medical specialty. This can be of particular benefit while traveling or living away from campus.

- Benefits are included for emergency assistance while traveling outside the United States.

- The plan covers an academic year, starting August 15 of the current year and ending August 14 of the following year.

It is important to know that The Columbia Plan meets and exceeds the requirements for the following:

- Health Insurance Portability and Accountability Act (HIPAA)

- U.S. Department of State Exchange Visitor Program for International Students & Scholars

- Affordable Care Act (ACA)

- New York State Department of Insurance

*Some services may not incur a co-pay in some situations.